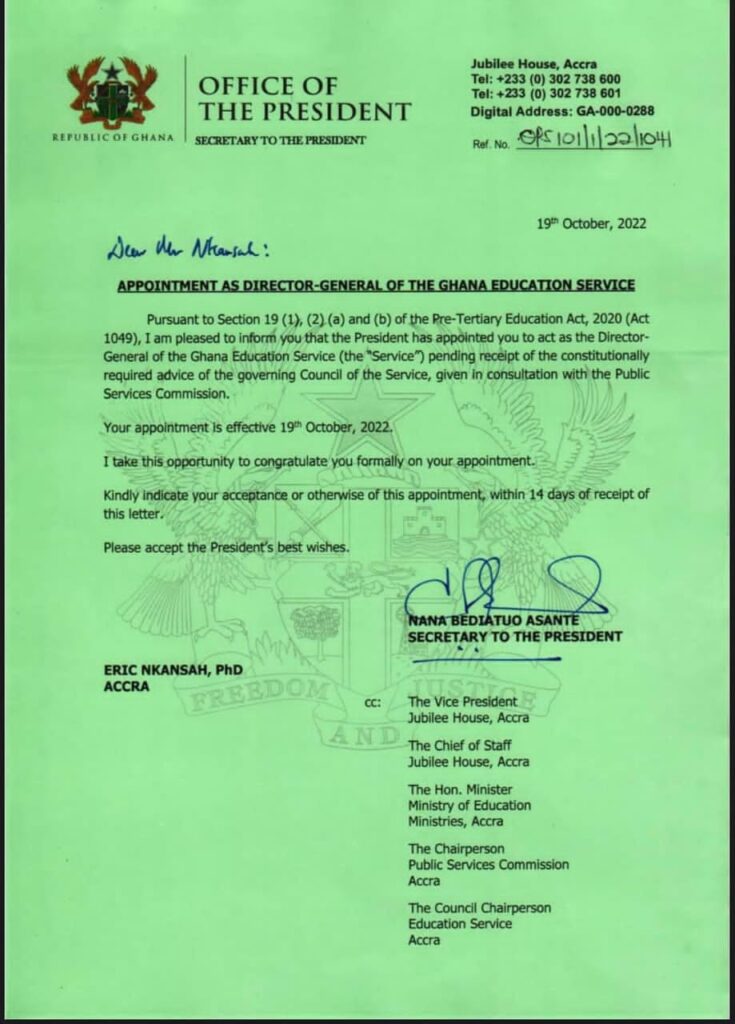

All You Need To Know About The New Director General of Ghana Education Service, Dr. Eric Nkansah

The President of the Republic of Ghana has appointed Dr. Eric Nkansah as the Acting Director General of Ghana Education Service. Dr. Eric Nkansah until his appointment was the Technical Advisor/Director in charge of Tertiary Education at the Ministry of Education. He was seconded to the Ministry of Education by Kumasi Technical University, where he served as Senior Lecturer at the Department of Banking Technology and Finance. Since joining Kumasi Technical University in September 2012 (then Kumasi Polytechnic), hr has contributed heavily in teaching, research, programme development and community service to the development of the university. He replaces Prof. Kwasi Opoku Amankwah who was relieved of his position yesterday.

Brief Bio:

Dr. Eric Nkansah has over the last 13 years fervently worked as a banker, lecturer, researcher, and a financial consultant. He is presently a Senior Lecturer at the Department of Banking Technology and Finance of this University. He joined the University in 2012 and has since contributed significantly (in the area of teaching, research, programme development etc) to the development of the University. Before joining the University, he was the Sales Manager at the Krofrom Branch of Barclays Bank of Ghana (now Absa) where he worked for over five years.

Education:

- PhD (Financial) Economics; University of Zululand, South Africa (2015 – 2018)

- Master of Business Administration (Finance); KNUST Business School, Ghana(2008 – 2010)

- B.A (Hons) Economics; University of Cape Coast, Ghana (2002 –2006)

Professional Membership:

Chartered Institute of Bankers (ACIB)

Research Interests:

Emerging and Frontier Financial Markets; Behavioural Finance; Sustainable Banking; Governance of Financial Institutions; and Risk Management in Banking

Teaching Areas:

Credit Management, Banking Operations, Treasury Management, Risk Management, Corporate Governance, Finance of International Trade, Financial Markets, Investment & Portfolio Management, Financial Economics and Financial Management

Conferences Attended:

- MBALI International Conference, University of Zululand, South Africa, September 2016

- 3rd Academic International Conference on Social Sciences and Humanities, Oxford University (UK), August 2017

- 2nd MBALI International Conference, University of Zululand, South Africa, October, 2018

Publications:

- Nkansah, E. and Kaseeram, I., Currency Carry Trade Profitability: Evidence from Emerging and Frontier Markets in Africa, Frontiers in Finance and Economics, Volume 15 (1), December, 2018.

- Nkansah, E. and Kaseeram, I., The Emerging and Frontier Africa’s Currency Carry Trades: Any Value to Asset Allocation Decisions? African Journal of Business and Economic Research (AJBER), Volume 13 (2), August, 2018.

- Nkansah, E. and Kaseeram, I., Currency Carry Trade Profitability: Evidence from Emerging and Frontier Markets in Africa, 3rd Academic International Conference on Social Sciences and Humanities, Oxford University (UK), Conference Proceedings, pp. 61-69, August, 2017.

- Asiedu, G. Maxwell, Nkansah, E. and Aawaar, M. Godfred, Determinants of Capital Structure of Listed Firms in Ghana: A Comparative Study of Financial, Manufacturing, and Retail Firms, International Research Journal of Finance and Economics, Issue 157, November, 2016.

- Asiedu, G. Maxwell, Nkansah, E. and Aawaar, M. Godfred, Assessing the Factors Driving the Collapse of Microfinance Institution in Ghana, International Research Journal of Finance and Economics, Issue 152, August, 2016.

- Oware, K. M. and Nkansah, E., Housing Finance in Ghana: Determinants of Mortgage Demand, International Research Journal of Finance and Economics, issue 118, January, 2014.

- Nkansah, E. and Oware, K. M., Innovation and Creativity Strategy and Production Machine Efficiency in Ghanaian Mining Industries, Research Journal of Economics and Business Studies, Volume 3, No. 1, November, 2013.

- Nkansah, E. and Oware, K. M., Impact of ICT on the Financial Performance of Rural Banks in Ghana: A case study of selected Rural Banks in Ashanti Region, Research Journal of Economics and Business Studies, Volume 2, No. 10, August, 2013.