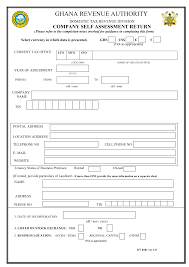

Ghana revenue authority forms

The Ghana Revenue Authority is the Ghana administration charged with the task of assessing, collecting, and accounting for tax revenue in Ghana. i.e. the Customs, Excise and Preventive Service (CEPS), the Internal Revenue Service (IRS), the Value Added Tax Service (VATS) and the Revenue Agencies Governing Board (RAGB) by the Ghana Revenue Authority Act 2009, (Act 791).

GRA FORMS

Download the GRA forms via the links below :

DT-0137-Monthly-VAT-NHIL-COVID-19-Flat-Rate-Return-Ver1.0

DT_0101_company_income_tax_self_assessment_return_form_v1

How do I download tax forms?

Get the current filing year’s forms, instructions, and publications for free from the Internal Revenue Service (IRS).

- Download them from IRS.gov.

- Order by phone at 1-800-TAX-FORM (1-800-829-3676)

How do I file my GRA return online?

The Taxpayers portal can be accessed at www.taxpayersportal.com. The portal app can also be downloaded as Ghana Taxpayers’ App on Google Play Store or App Store. GRA offices will not accept manual returns from the above-mentioned groups of taxpayers from April 1, 2022.

What is the time frame for submission of returns?

At the end of the year, all taxpayers are required to file final tax returns and pay any tax outstanding. The final return and tax are due within four months after the financial year-end. There are also instances where the C-G may issue an additional assessment after the conduct of an audit.

What can I do on the Taxpayers’ Portal or App?

- File your returns

- Initiate payment of your taxes

- Apply for Tax Clearance Certificate

- Apply for Tax Relief

- Apply for Withholding Exemptions

- View your Receipts and Tax Credits

- Apply for Tax Refunds

- View Tax Statements

- Update your GRA information (eg. Contact details, etc.)

- Make other requests to your Tax Office