ghana revenue authority tin form

A Taxpayer Identification Number (TIN) uniquely identifies taxpayers or potential taxpayers (that is individuals and corporate bodies) for tax purposes. Section 10 to 12 of the Revenue Administration Act 2016, (Act 915), authorizes the Commissioner-General of the Ghana Revenue Authority (GRA) to maintain a Taxpayer Identification Numbering System of people who are liable to register and pay tax to the state.

For this purpose, from April 1, 2021, the Ghana Card Personal Identification Number (Ghana card PIN) is now being used as a form of Taxpayer Identification for INDIVIDUAL TAXPAYERS ONLY.

This means that the Ghana card PIN has replaced the TIN issued by GRA to Individual Taxpayers from April 1, 2021.

How to get an Individual TIN

You must register for a Ghana Card which is issued by National Identification Authority (NIA) and use the PIN provided as your New TIN from April 1, 2021.

The NIA is being co-located at selected GRA DTRD offices namely:

to register individual taxpayers who have TIN but do not have Ghana card PIN for tax purposes.

Where You Need A Ghana Card PIN

as a Replacement of Your TIN

The Ghana card PIN is used in all tax-related transactions and other legal transactions which require the use of an individual’s TIN. These include;

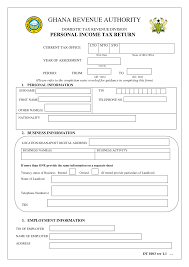

The GRA tin form can be downloaded via the provided link below :

taxpayer_registration_form_organisation